Welcome, bubbleheads. A guest post today from Sara Danese of In The Mood For Wine:

Last Autumn, Sara and I took a look at what was going on with Champagne Investments:

Is it worth investing in Champagne?

Welcome, bubbleheads. A look at a slightly contentious topic this week : the market for Champagne, with thanks to merchant and investment specialist Sara Danese. Also, a quick note to say that the England Special Report 2022 is finally here! A real labour of love this year, with almost 300 wines tasted, fourteen awards, in-depth analysis and a feature o…

Nine months on, how are things looking? Over to Sara:

The State of Champagne in 2023

When market optimism reaches a fever pitch and asset prices defy gravity, it sets the stage for a potential bubble.

This is the scenario we found ourselves contemplating back in October 2022: Should we invest in Champagne? And if so, is it worth doing so at the current prices? Are we in a bubble?

Now that the Champagne market has experienced a complete shift, it is clear that, yes we were in a bubble. As we analysed the buoyancy of the previous year, we attributed it to a combination of three factors:

Firstly, there was a general market hype surrounding commodities and tangible assets, including passion assets like fine wines and luxury watches.

Secondly, the Fear of Missing Out (FOMO) had a significant impact. Exceptional Champagne vintages, such as 2012 and 2008, were being released ahead of a decade of comparatively less remarkable ones.

Lastly, there was a growing interest in "grower champagne," which historically offered value for money from lesser-known producers.

This mesmerising market dynamic captivated investors, resulting in a frenzy of buying as participants chased ever-inflating prices.

The saying "what goes up must come down" holds true, but when it comes to financial markets, prices tend to revert to their mean or equilibrium levels. This phenomenon, known as mean reversion, suggests that over time, prices have a tendency to return to their long-term averages. You can visualise it as a pendulum swinging back and forth.

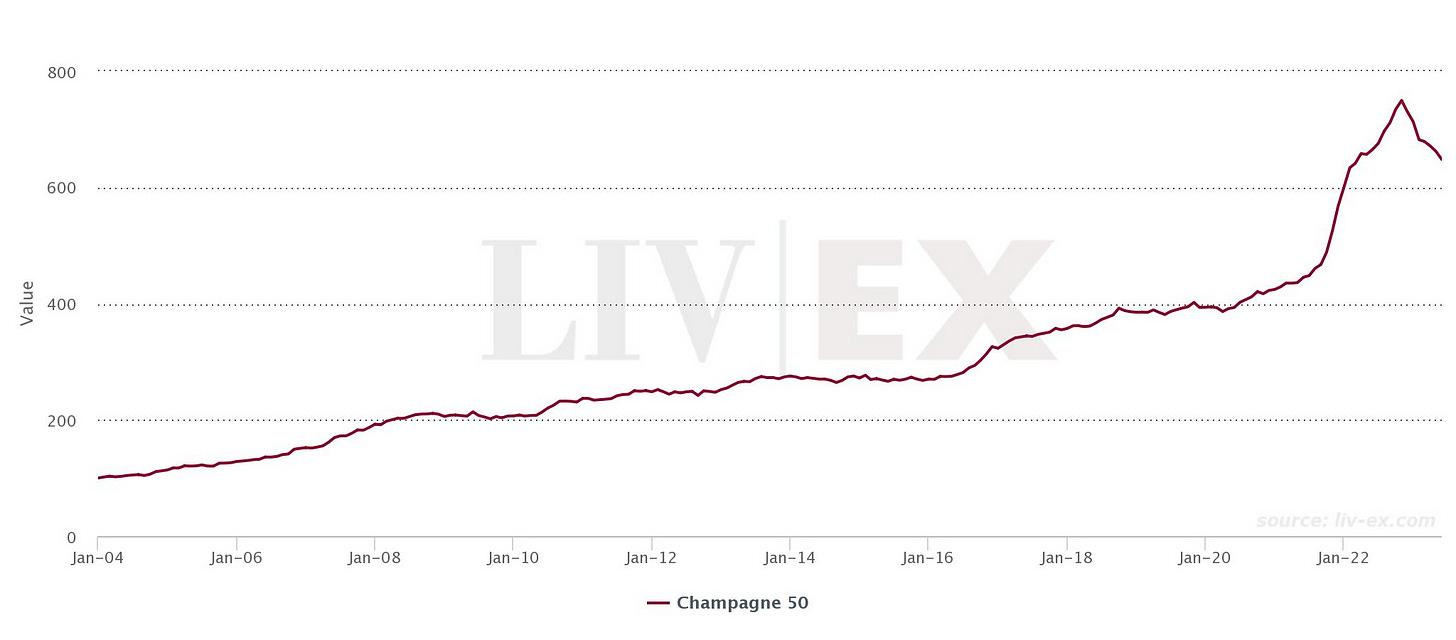

Interestingly, the Champagne 50 index displayed strong performance from the second half of 2021 until October 2022. However, since then, the index has experienced a 13% decline, along with the rest of the fine wine market.

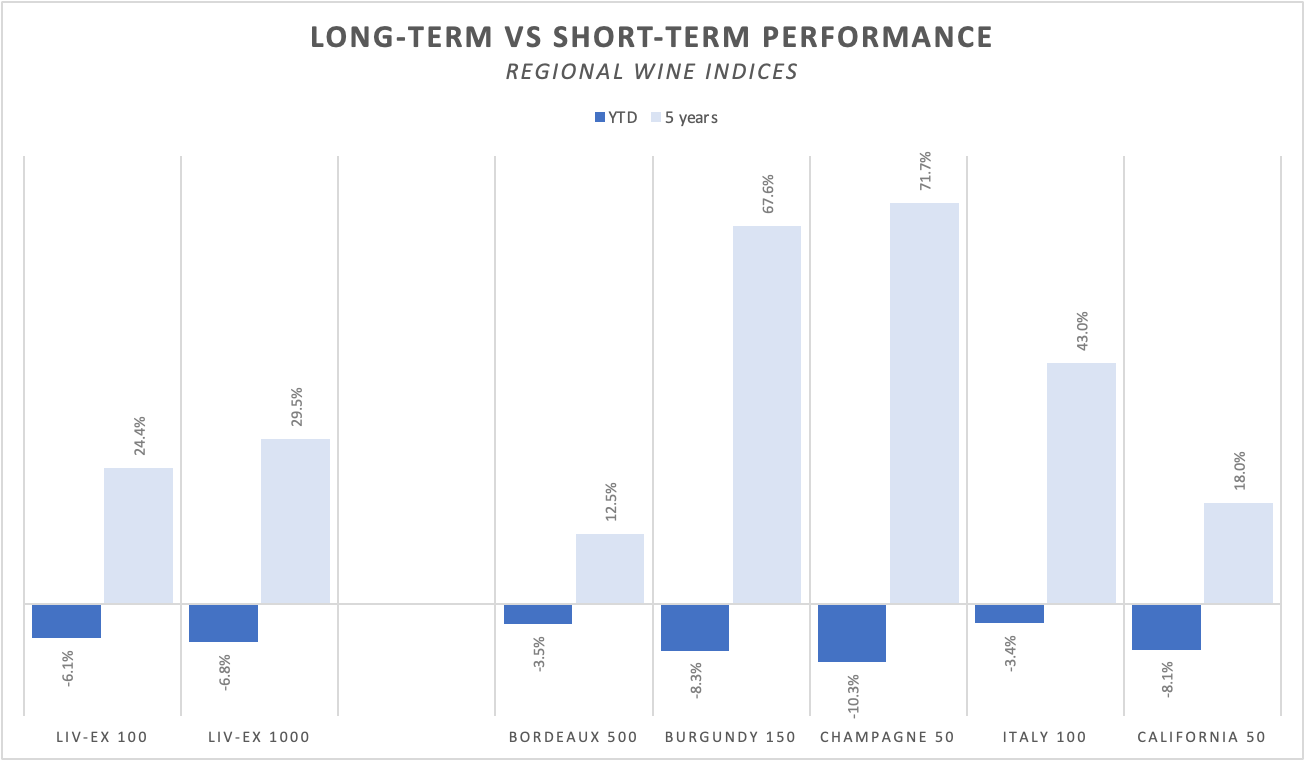

A glance at the chart below reveals that Champagne, as measured by Liv-ex, exhibited the largest fluctuations, swinging between its long-term performance (+71.7%) and its year-to-date (2023) correction (-10.3%).

Source: Liv-ex, In the mood for wine

These wild fluctuations were unusual for Champagne, which historically has been more conservative and stable, akin to bonds:

Source: Liv-ex

This bubble burst in October 2022, coinciding with a general cooling of the fine wine market. Wine merchants likely expected the Champagne rally to continue at least through the December holidays. However, disappointing December numbers set the stage for a change in market sentiment.

Market Sentiment

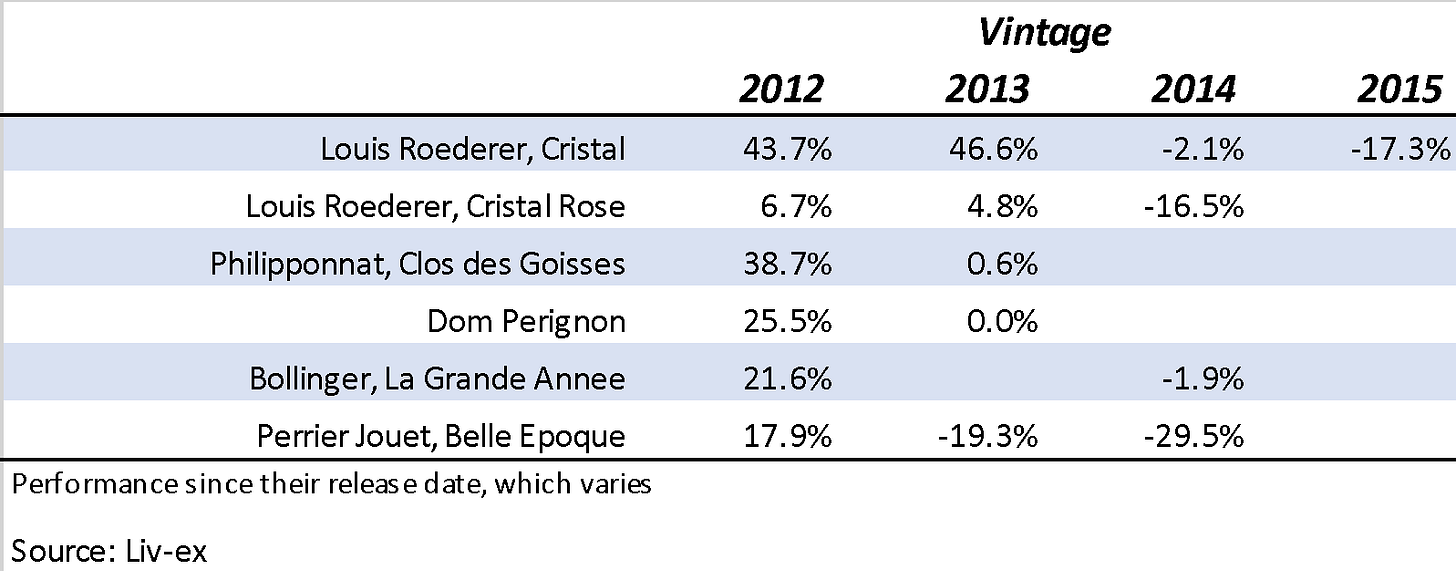

Market sentiment affects the performance of released vintages. Cristal 2012, which was released in 2019 at £1,670 (12x750ml bottles), reached a peak of £3,050 in late 2022 before falling to the current level of £2,400. Similar behaviour can be observed among other brands.

Dom Perignon 2012 recorded more modest returns simply because it was only released in September 2021, thus not benefiting from the extra two years of tailwind:

Source: Liv-ex

Cristal 2013 vintage, released in early 2021 at a lower price of £1,490, experienced a 118% price increase in the first 18 months since its release but has now settled for more modest gains. In contrast, both the Dom Pérignon and Philipponnat Clos des Goisses 2013 vintages have not seen significant price increases yet. This is because they were released more recently when the market had already started cooling.

Additionally, both houses decided to increase the release price compared to their respective 2012 vintages, which may have contributed to market scepticism. Similar conclusions can be drawn for Cristal 2014 and 2015, both of which were released more recently at a large premium over 2013 and 2012, arguably better vintages.

A market that has experienced such a decline becomes a buyer's market. The question now is, which vintage and which Maison should one consider?

Source: Liv-ex. All prices are as of 31/05/2023.

A few general observations:

2012 is rightly priced higher than other vintages due to its additional ageing and quality, and its release coincided with more favourable market sentiment.

The 2014 and 2015 vintages released so far are priced higher than the 2013 vintage, which aligns with a higher inflation regime but makes them unattractive to buyers.

2013

Across the board, the 2013 vintage seems to trade at a discount, not only from their 2012 counterparts but also from the respective 2014 and 2015 vintages. In most cases, 2013 appears to be very fairly priced, especially considering the quality of the vintage.

For example, Dom Pérignon, owned by the LVMH group, had a thoughtful 2013 release price policy, incrementing its release price by a reasonable 26%. Currently, the prices of Dom Pérignon 2012 and 2013 trade at a very similar level (£1,820 and £1,830, respectively), and Clos des Goisses 2013 is being sold at a mere 7% discount compared to 2012. Deciding which vintage to buy is likely a matter of personal taste; however, Dom Pérignon and Clos des Goisses 2012 still feel like a fantastic bargain!

2014 & 2015

Let's now explore the quality of the 2014 and 2015 vintages. Despite being a challenging vintage, 2014 produced some successful wines with attractive fruit, lovely vibrant acidity, and an overt easiness.

Regarding 2015, the quality and ageing capacity of the vintage have been questioned, and Essi Avellan MW has, amongst others, raised concerns about the aromatics. [Scores for 2015 releases so far proven lower than 2014s and 2013s, too]. Releasing these wines at a premium or at the same price as back vintages found in the market misses the point and likely only serves to annoy buyers.

Let's take Cristal 2015 as an example. Its current price of £2,258 trades at a premium compared to the 2013 vintage. However, if we compare their release prices, the 2013 vintage was released in 2021 at £1,490, while the 2015 vintage was released a few months ago at £2,729. That's an 83% increase in the price released by Roederer, far beyond any reasonable justification for inflationary forces!

Since its release, there has been an 18% decline in its price. However, this phenomenon is not unique to Champagne. Earlier this year, we witnessed how the Bordeaux En Primeur 2022 campaign left a bitter taste in the mouths of fine wine collectors. Asking people to pay more for the 2022 vintage than they can pay for a known great year that is ready to drink defeats the purpose of en primeur.

Although Liv-ex does not disclose volumes, the sharp decline of the Champagne 50 index (which represents a weighted average of 50 vintage wines from 10 Maisons) suggests that new releases have done little to drive interest in current and back vintages.

Tom’s Comment

Cristal 2015’s immediate drop in value may cause a few houses to think twice about pushing prices too far in 2023. The idea of a ‘discount’ being available is the very last thing Champagne houses want to allow for their Prestige wines.

Might all this have a knock-on effect for those of us just looking to buy champagne to enjoy and drink, rather than with one eye on investment? Perhaps the supply-side price rises, even at the NV and entry-level end of the market, may have to slow down. With inflation still rampant in the UK at least, though, I wouldn’t be holding my breath for a slew of bargains any time soon.

Whether the investment market dynamics will trickle down to those involved in indie and grower champagne remains unclear; anecdotally things don’t seem to be slowing down yet. I wouldn’t, in other words, be holding my breath for bargain Collin, Egly-Ouriet and Bouchard, either. The rush for new indie champagnes, too, runs on a slightly different engine - I’m not sure how much it will be affected by price fluctuations in Dom Pérignon.

Ultimately, Champagne is different to Bordeaux in that, even for Prestige Cuvées, it has one foot in the market, and one on the shelf or wine list. How would you feel, as a restaurant buyer, if you were forced to list a 2015 vintage at an elevated price only to see it available in the market shortly afterwards at a huge discount? Not a problem Bordeaux is faced with in the same manner.

Champagne’s bread-and-butter is as a wine to drink, not invest in, and if the markets start playing havoc with that then the region risks losing real-life engagement in its top wines. Perhaps it’s high time to return, then, to slow-n-steady.